If you have a disability, you qualify for an RDSP, and one was opened for your benefit, the RDSP is yours. You may not be the right person to manage it, however. In this case, you can open an RDSP and appoint someone you trust to be the Holder of the RDSP.

The Holder is the person who manages the plan and makes decisions around investments and payment options. You are probably the Holder if you are an adult and you have contractual competence*.

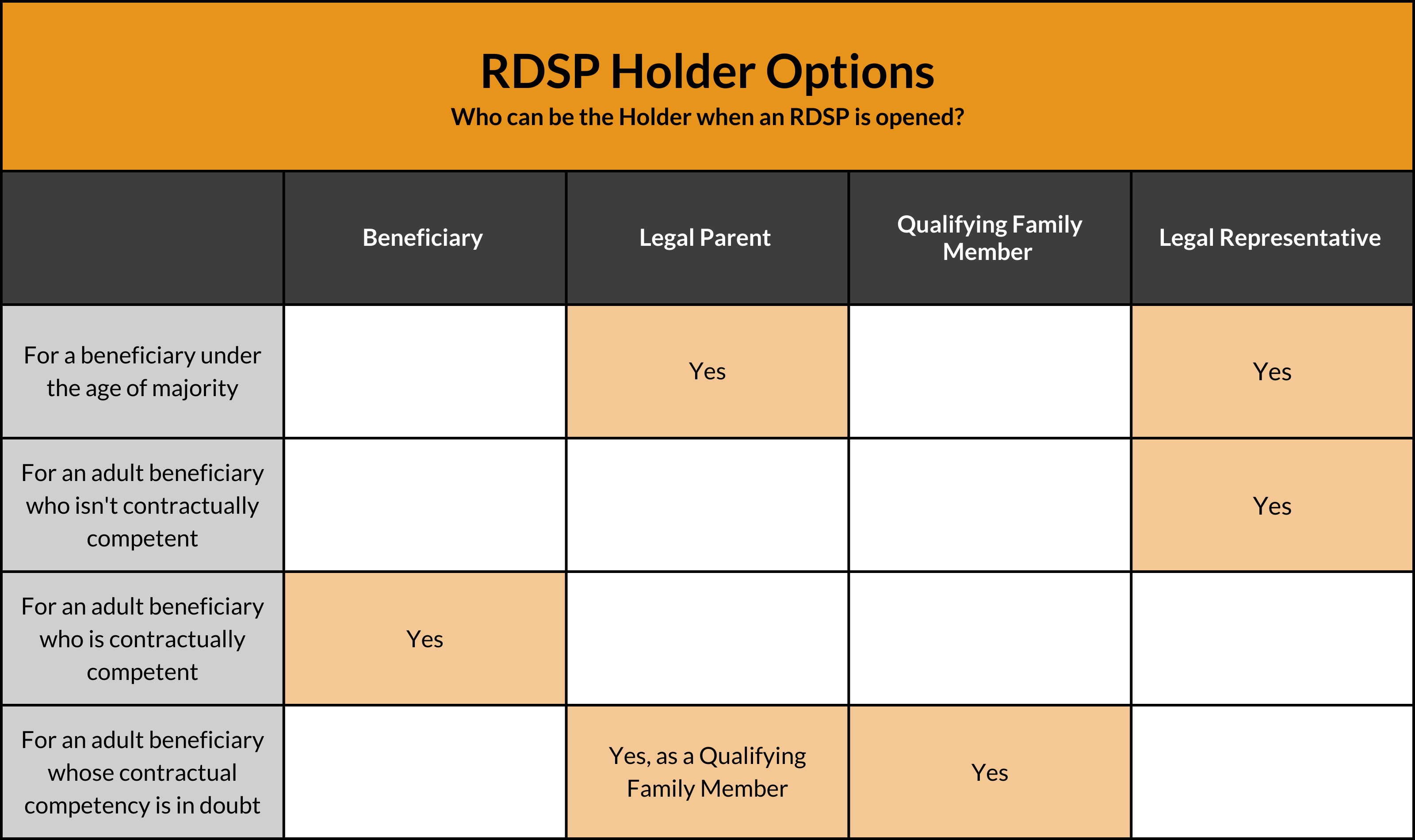

Please see the chart below for the holder options. If the legal parent(s) are holders of the RDSP for the beneficiary while they were under the age of majority, the legal parent(s) could remain sole holder(s) of the plan or be added as a joint holder. You can have up to three joint holders in this situation.

Who can be a Qualifying Family Member?

- A legal parent of the beneficiary.

- A spouse or common-law partner of the beneficiary who is not living apart and separate from the beneficiary because of a breakdown of their marriage or common-law partnership.

- An adult sibling of the beneficiary.

*Contractual competence: Financial institutions need to ensure that people opening an RDSP are able to manage their financial affairs. If they don’t think a person can, they may question their ability to be “contractually competent” and therefore question their ability to be the RDSP Holder. The role of the Holder is to open, manage, and make decisions about the RDSP investments and payment options. If the financial institution doesn’t’ think the person is able to be the Holder, they request that the person have a legal representative to be the Holder and manage the RDSP on their behalf.

In British Columbia, someone can also appoint a representative through a Representation Agreement, which provides supported decision making for the RDSP beneficiary. Click here to find out more.