Ensuring That Kendra Can Make More Personal Choices

For Kevin and Simon Porter and their nine-year old daughter Kendra, it comes down to choice. It’s a concept that most people take for granted, but something that is dearly important to most of us. It is the ability to choose.

Kendra is a gifted young girl who loves drawing, photography, and really anything to do with art. She attends grade four in her hometown of Brandon, Manitoba, and has an insatiable amount of energy for activity; learning and experiencing everything she can in life.

Kendra recently went on an overnight field trip with her class to visit one of the museums in Winnipeg. Her parents were a bit nervous but also very proud. A two-day road trip with your elementary class, and without your parents, is a big step for any 4th grader. The fact that Kendra has complex needs and was able to participate represents a big step for the young girl who is becoming more independent.

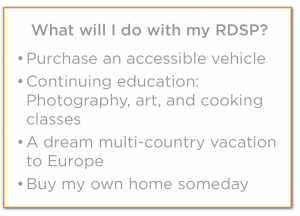

Kendra loved the trip, and now dreams of seeing all of the world’s great museums. The question of choice and independence is paramount in Kevin and Simon’s mind when considering Kendra’s future. They want to make sure that whatever their daughter pursues, she has the resources to do it.

With the often restrictive nature of many disabilities, Kevin and Simon see the RDSP as a way of ensuring their daughter can make personal choices when deciding her future, be it taking courses in a post-secondary institution or getting a job doing something she loves.

With the RDSP as a resource, Kevin and Simon want Kendra to be able go where she wants to go, do what she wants to do, and make more choices that lead to a sustained quality of life.

After taking a look at their finances, Kevin and Simon are planning to contribute $125 a month for 20 years. Having already saved for Kendra with the help of her extended family, Kevin and Simon are also looking to transfer an initial $10,000 into Kendra’s plan right from the start.

So what is Kendra’s RDSP going to look like?

Kevin and Simon turned to Plan Institute’s RDSP Calculator –– by inputting their daughter’s age, their income levels and planned contributions, they learned that Kendra will have over $400,000 in her RDSP by age 40, which is about when she would be ready to start withdrawing.

What’s more, if she chose to follow the plan’s programmed payments (which have an auto default ending at age 83) her RDSP would have well over a million dollars over her lifetime, and pay out an average of $35,000 per year.

Or she can choose to withdraw much larger amounts earlier. All to spend on whatever she likes, like a house down payment and that dream vacation. There is a lot of flexibility with RDSP payments, and it will not affect her provincial disability income assistance and benefits.

Try it out for yourself. Go to www.rdsp.com/calculator/ and input the following:

INPUT SUMMARY

Current Age: 9

Year RDSP Was Opened: 2015

Year qualified for the Disability Tax Credit: 2008

Family Taxable Income: over $90,000

Kendra’s Adult Income: less than $25,000

Annual Personal Contribution: $1,500 a year ($125 a month)

Family Contributions until age: 39

Estimated Return: 5.0%

Lump Sum Personal Contributions: $10,000 at age 9

Age to begin payments from the plan: 43

Hit Calculate!

RESULTS SUMMARY

Estimated Value of the RDSP when beginning withdrawals (age 43): $464,171

Maximum Annual Payment at age 43: (10% of plan value): $46,417

Minimum Annual payment starting at age 43: $22,103

Average Annual payment if RDSP is kept open to age 83: $35,045

Estimated total in RDSP if kept open to age 83: $1,401,796

Total Personal Contributions: $56,500

Total Grant over 20 years: $70,000

Total Bond over 20 years: $20,000

Note: The RDSP Calculator is a tool to help you assess the potential of opening and contributing to an RDSP. The estimates provided by the Calculator are for information purposes only. The profile of your RDSP may differ from the RDSP Calculator projection.